Juanita Katt Biography: Life, Career, Family & Legacy

Introduction to Juanita Katt

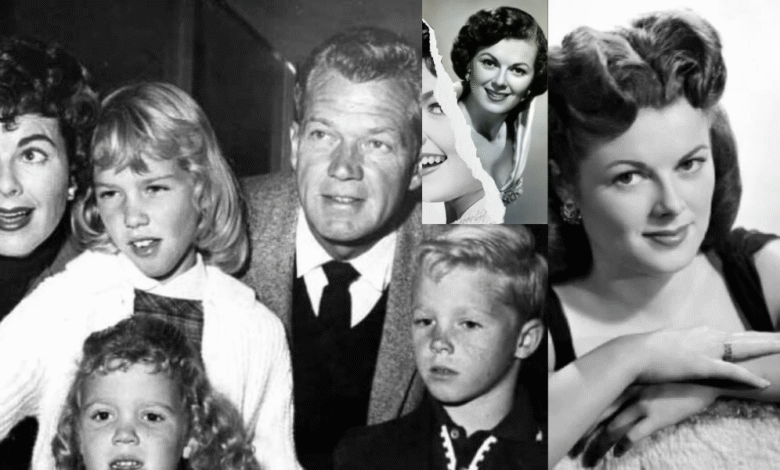

In the golden age of Hollywood, many children were born into the dazzling spotlight because of their celebrity parents. Some embraced fame, while others chose quieter paths. One such personality is Juanita Katt, the daughter of the legendary American actors Barbara Hale and Bill Williams. While she lived away from the constant media attention compared to her famous family members, her life remains intriguing to fans of classic cinema and television. This biography offers a closer look at her story, covering her early life, background, family connections, and the legacy she carries as the daughter of two celebrated stars.

Early Life of Juanita Katt

Juanita Katt was born on December 22, 1953, in Los Angeles, California, during a time when Hollywood was flourishing with classic film productions and iconic television shows. Growing up in a household where both parents were established actors, her life was naturally influenced by the entertainment industry. Her mother, Barbara Hale, became a household name for her role as Della Street in the long-running legal drama Perry Mason. Her father, Bill Williams, was also widely recognized for his starring role in The Adventures of Kit Carson.

Despite having such famous parents, Juanita’s early life was more private compared to the constant flashing cameras that usually followed celebrity families. She spent her childhood in California, enjoying the privileges of being a star child but also experiencing the expectations that came with it.

Family Background and Hollywood Heritage

Juanita Katt’s family tree is filled with Hollywood connections. Her parents were not only successful actors but also admired figures in the American entertainment industry.

- Barbara Hale (Mother) – Known for her Emmy Award–winning performance in Perry Mason, Hale’s career spanned film and television. She worked with greats such as Frank Sinatra and James Stewart, leaving an unforgettable mark on the industry.

- Bill Williams (Father) – Star of The Adventures of Kit Carson (1951–1955), he was a beloved actor whose career showcased his versatility and charisma.

- Siblings – Juanita grew up alongside two brothers, William Katt and Jody Katt. William Katt went on to become a successful actor himself, remembered for his lead role in The Greatest American Hero and his appearances in the film adaptation of Carrie.

The Katt family, therefore, represents not only a personal connection to classic Hollywood but also a lasting contribution to American entertainment history.

Career Choices and Life Away from the Spotlight

Unlike her brother William, who pursued a professional acting career, Juanita Katt did not step directly into Hollywood’s limelight. Information about her professional career is scarce, suggesting that she may have chosen a life outside of acting. Many star children often seek lives away from fame to enjoy privacy and independence, and Juanita appears to have embraced this approach.

While she may not have followed her parents into acting, her life is often referenced by fans of Barbara Hale and Bill Williams, who are curious about the children of such iconic personalities. Her decision to remain private is also a statement of individuality in a family that is often dominated by public attention.

Personal Life of Juanita Katt

Because Juanita has kept her personal affairs private, little is publicly known about her relationships, family life, or professional pursuits. This is one of the main reasons why she stands out compared to her brother William, whose acting career brought him into the public eye. However, this privacy has also protected her from the pressures and scrutiny that many celebrity children face.

Fans often speculate about her personal life, but reliable public records remain limited. What is clear, however, is that her bond with her family was strong, especially with her mother, Barbara Hale, who was widely regarded not only as a talented actress but also as a dedicated mother.

Barbara Hale’s Influence on Juanita Katt

Barbara Hale’s career inevitably shaped Juanita’s life in both direct and indirect ways. As the only daughter in the family, Juanita was close to her mother, who managed to balance her acting career with her domestic responsibilities. Barbara Hale was celebrated for her role as Della Street, a character who became an iconic representation of intelligence, loyalty, and professionalism.

Growing up with such an influential mother likely instilled in Juanita the values of dedication and resilience. Even though Juanita chose a quieter life, the discipline and grace exhibited by Barbara Hale undoubtedly played a role in her upbringing.

Relationship with Her Father Bill Williams

Bill Williams, Juanita Katt’s father, was another strong influence. Known for his rugged screen presence and classic Western roles, Williams represented the image of the ideal American leading man in the mid-20th century. Juanita’s childhood would have included experiences of seeing her father on television and meeting the many colleagues and friends from Hollywood’s golden years.

Sadly, Bill Williams passed away in 1992 after a long career, but his legacy continues to live on not only in his films but also through his family.

The Sibling Bond: William and Jody Katt

Family bonds played a crucial role in Juanita’s life. Her brother William Katt achieved fame in his own right, giving the family another generational link to Hollywood. Known for his acting in television and movies, William brought the Katt name back into the spotlight during the 1970s and 1980s. Juanita’s other brother, Jody Katt, remained more private, much like Juanita herself.

Together, the three siblings represent different paths chosen by children of famous parents: one embraced the industry, while the others opted for quieter lives. This balance shows how the Katt family navigated fame across generations.

The Legacy of Juanita Katt

While Juanita Katt may not be widely recognized in entertainment circles, her significance lies in preserving the values and personal history of the Katt family. By maintaining privacy and upholding the traditions set by her parents, she showcases a different but meaningful aspect of the family’s ongoing Hollywood legacy.

Her legacy is defined not just by being the child of two celebrated actors but by embodying the quieter dedication, privacy, and values that often remain unseen in Hollywood families. Through her choices, she highlights how legacies can be continued beyond public achievements, contributing to the Katt family’s enduring influence on American entertainment history.

Remembering the Star Child of a Golden Era

The fascination with star children like Juanita Katt comes from the curiosity of fans who admire their famous parents and wonder about their lives beyond the screen. While Juanita has chosen to remain away from the spotlight, her name continues to be mentioned whenever fans celebrate the careers of Barbara Hale and Bill Williams.

She reminds us that the children of stars often live lives shaped by the glamour of Hollywood but also by the desire for privacy and normalcy. Her story is a balance between fame and a personal journey.

Conclusion

The story of Juanita Katt is a fascinating reflection of what it means to be the child of Hollywood legends. Born into fame but choosing to live away from its constant glare, she remains an intriguing figure in her family’s legacy. While she did not pursue a career in the entertainment industry like her brother William, her life is a reminder that not all star children are destined to follow the same path.

Her parents’ remarkable contributions to film and television, along with her brother’s acting career, ensure that the Katt family’s name will always hold a special place in American entertainment history. For fans of Barbara Hale and Bill Williams, Juanita Katt represents the personal side of Hollywood’s golden age—the side that chooses family, privacy, and legacy over the spotlight.